#11-16 8.0% PPI, CASH ON THE SIDE, TREASURY ROTATION, $SPX $SPY $ES_F LEVELS IN TACT

CASH NOW PAY! Not enough demand has been destroyed, S&P500 levels and zones are in tact!

US PPI Y/Y: 8.0% (forecast 8.3%, previous 8.5%)

It was softer than expected in YoY terms for the US Core PPI (forecast 7.2%, previous 7.2%). This PPI number aligns with last week's CPI number. The FED does not want the market to price in a move higher until three consecutive lower inflation readings appear.

A short squeezed on the morning reaction to PPI caught shorts offside... again. We got the catalyst and wholesale was ready to run the upper stops. As a result, the markets are looking for inflation to break down and stay compressed. Inflation to stay compressed would be good news for traders and investors. The Fed should intervene less in the markets, according to most money managers.

In the midst of near-zero interest rates, the biggest tickers built up reserves which they used as a shield against higher margins. The cash on the side sentiment is that NOT ENOUGH DEMAND HAS BEEN DESTROYED. This sentiment suggests that the Fed will raise interest rates while they work to bring down an elevated inflation reading. This process could take longer than the market wants.

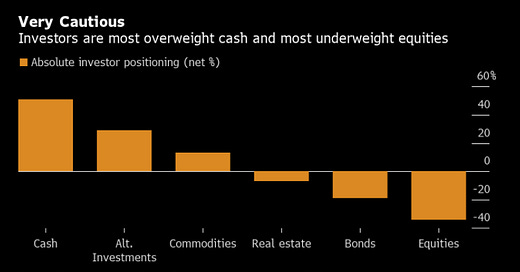

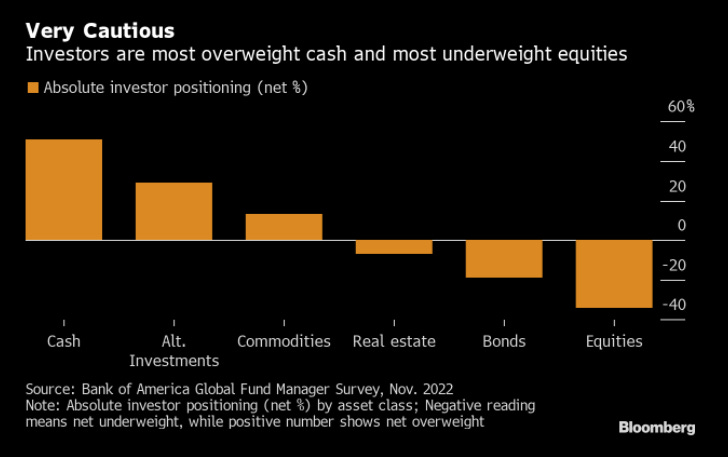

The BofA Global Fund Manager survey found that investor positioning remained very cautious in November, with a net 51% of investors overweight cash.

The BofA Global Fund Manager survey indicates investor sentiment also remains "uber-bearish," with 92% expecting stagflation by 2023, with long dollar the most intense trade. Investors are

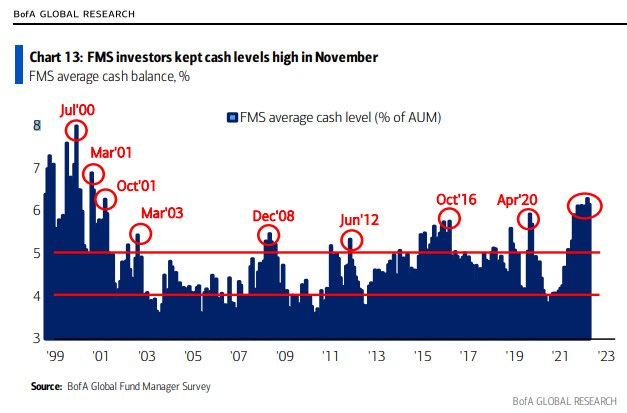

Most bears and sideline money say to sell this strength by Q1 earnings. Money managers have incentive to hold cash. Cash now pays. 6 Month Treasury Bills are trading at 4.43%. Treasuries risk:reward makes sense as money managers has to go through a re-pricing of equities to the new rate.

Long-term net longs need earnings for the S&P500 at 18x or at 225 next year. For 2025, earnings are projected to be 200. In the near market top, uncertainty surrounds how much people will be willing to pay for these higher earnings.

When the market still has to price in a slowing growth rate, earnings slipping into a recession, geopolitical tensions escalating, and the Fed's massive efforts to bring inflation down to just 2% from 7.7%. As a result, we will continue to see valuations being destroyed, resulting in structurally restrictive investing back into the core names during the next year.

E-MINI S&P500 Futures

Institutional money takes risks only between 1-2 days in the market at present. Interestingly, these large-sized trades managed by institutional money are traded within a T+2 settlement period and trade on shorter time frames. These market participants are trading to meet margin and to acquire a position with the purpose of liquidating into the strength or on the short liquidating into the weakness.

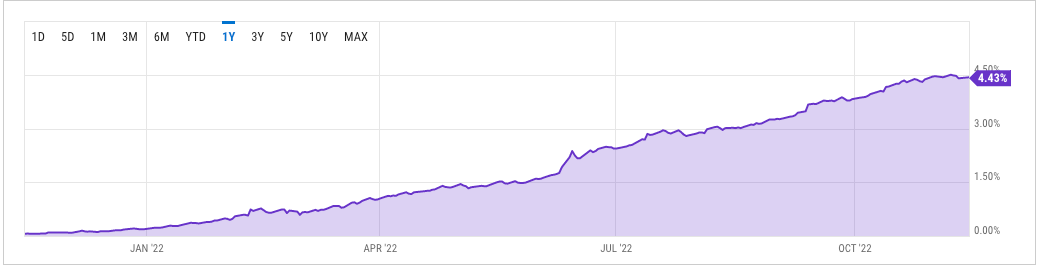

A wholesale liquidation above 4018 of the inventory market makers secured at 3993 occurred during this morning's S&P500 futures session. Net longs used the shift in sentiment to "peak inflation, peak yields, peak dollar and peak fed" as a catalyst for liquidity, and large size traders sold into it.

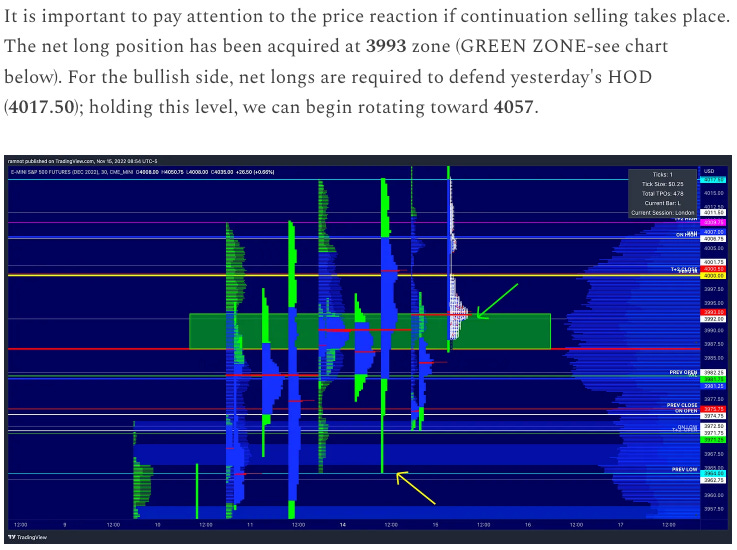

The GREEN ZONE above shows where the position of the size traders. This area was a key zone today, the bulls need to do more work to repair back over 4017.50.

The Volume Point of Control between Nov 9-Nov 16 is now 3993.25. Net longs did defend their core position. Now as long as we hold 3993.25, we can still rotate higher into 4057.

During RTH, bulls need to defend 3960-3964. This area will be the LAST LIS before we start to get rolling margin call selling.

Above the dollar cost average of the net long position at 3993.25, look for a move to trade in the range of 4012-4031 (YELLOW ZONE).

Institution Positioning - 13F