#11-28 | BLACK INFLATION FRIDAY, FED PIVIOT, CHINA ZERO, $ES_F $SPY $SPX KEY LEVELS

Look past the headlines and you'll see a BIG BEAR setup

This weekend, there were many consumers spending for the holiday season. Black Friday / Cyber Monday is the biggest retail event of the year as consumers spend to purchase their Christmas gifts. Adobe reports to spend as much as $9.2 billion on e-commerce. During 2021, Adobe reported $8.9 billion in e-commerce spending. As inflation has been 8% since the beginning of the year, and inventories are still reflective of higher input costs, these reported figures are adjusted for inflation. As a result of the adjustment, approximately $8.4 billion was spent on e-commerce.

Taking a look at the US Personal Savings chart, we have experienced a loss of $674 million over the past year. Consumers are using up their savings during this time of high inflation in order to meet their basic needs. The Federal Reserve anticipates that the economy will enter a recession sometime within a year. Rates will be slowed as well.

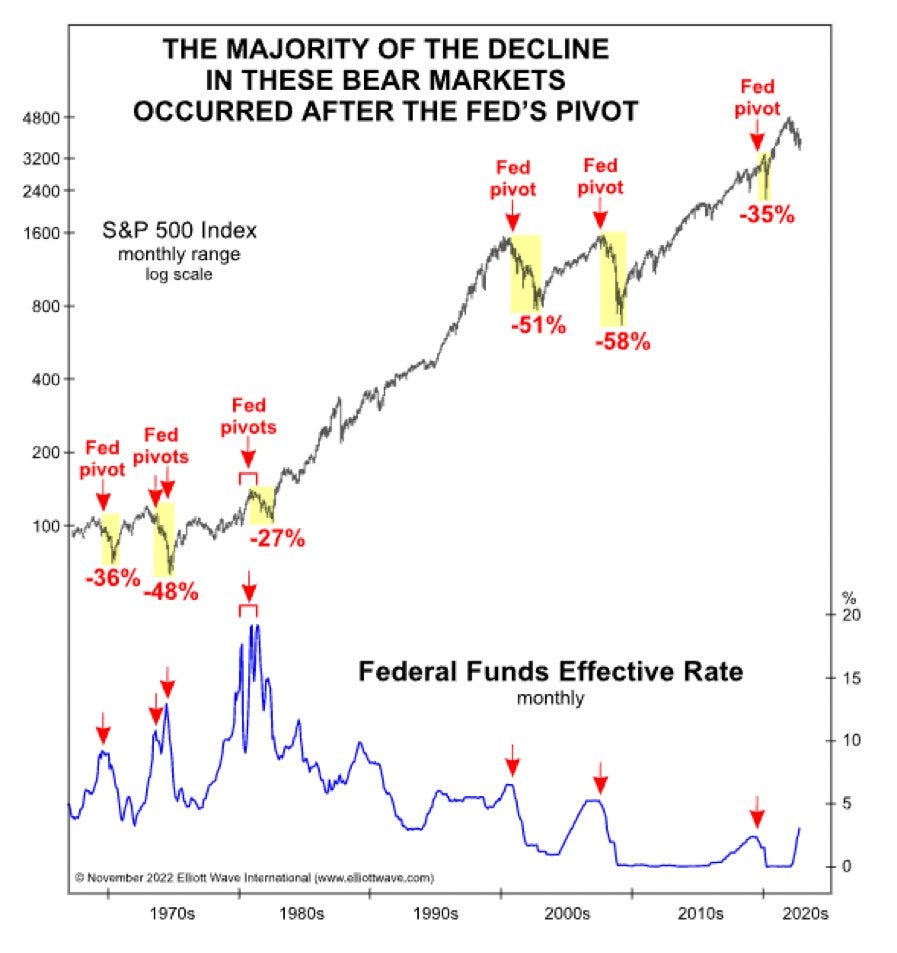

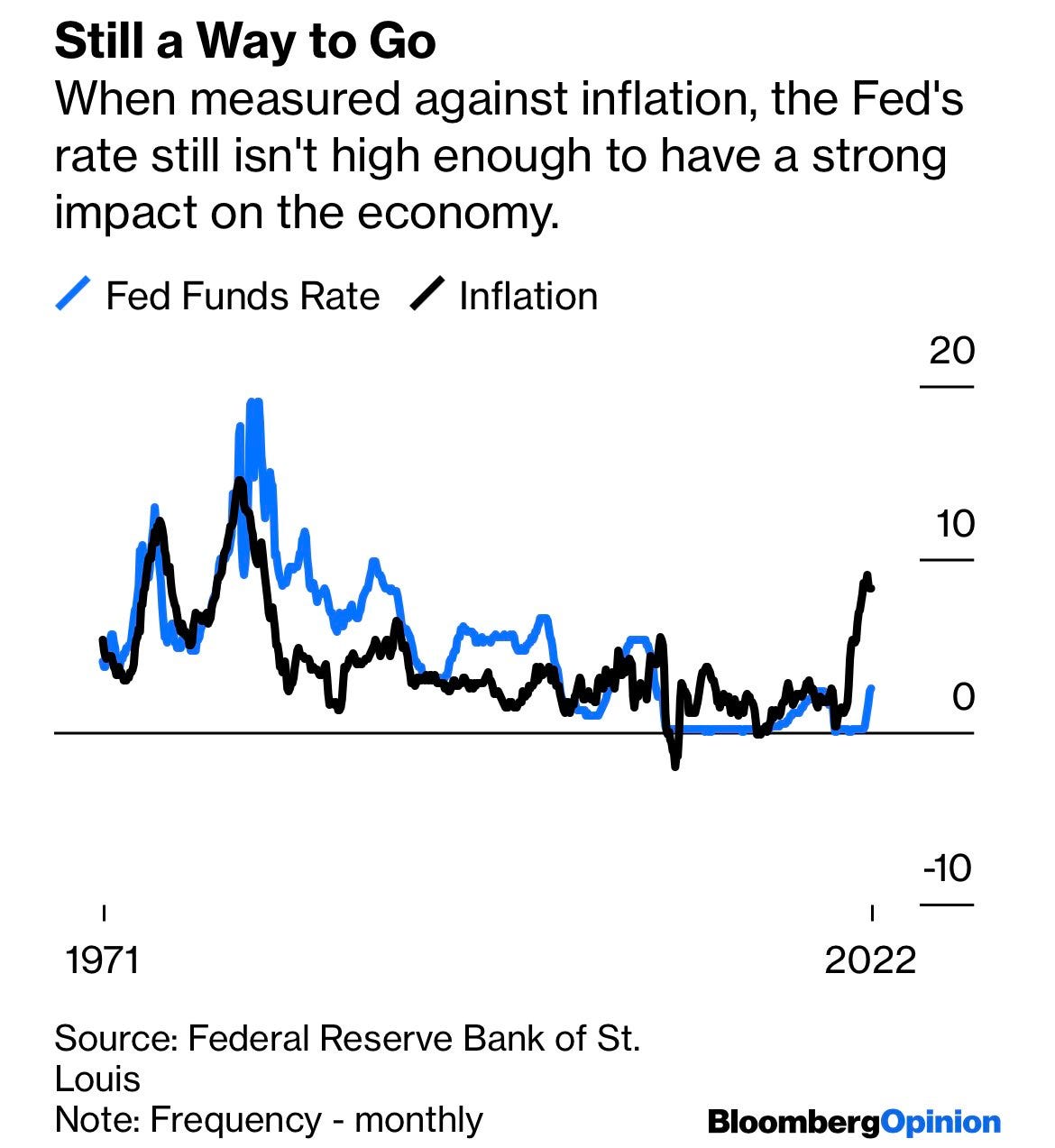

There is a fervent expectation among bulls for a Fed pivot, but history tells another story. When the Fed Funds Rate peaks, the majority of the bear market occurs. The bulls either say "this time it's different" or do not understand the impact of a "Fed Pivot" on the markets. Fed Chair Powell has repeatedly stated that the market should not get ahead of the idea that inflation has peaked and interest rates will cease rapid increases.

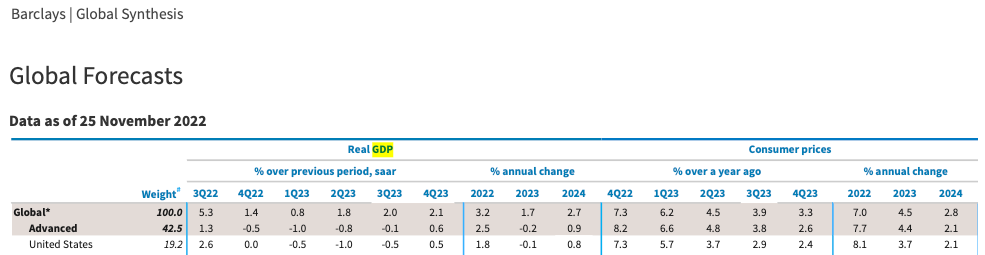

Even with the US entering a recession, our position is that we may find ourselves in much worse circumstances until geopolitical tensions begin to cool. According to Ken Griffin, Chief at Citadel, the US GDP would decrease by 5-10% if China invaded Taiwan and the US lost access to semiconductor resources, resulting in an immediate great depression for the United States.

As China seeks to invest in their own semiconductor Manhattan project, the US could face fragmentation of the technology stack and the future of students and job stability is uncertain. As China has four times as many STEM graduates as the US, it is possible that if China becomes the dominant supplier of semiconductors in the world, this could threaten the US' technology dominance.

In the last weekend, the Chinese have taken action against draconian prison camps designed to implement ZERO COVID. Global demand has also slowed rapidly in recent months, leading to an unexpected contraction in exports last month as a result of the outbreak in Guangdong province, a manufacturing hub which led to tighter restrictions on covid exports in October as outbreaks spread throughout the region. With the COVID surge in China, China's industrial profits are dropping, and prices are falling as well. China not reopening to the rest of the world is not good for growth and progress worldwide.

While we still face a number of challenges, not only global instability but also the likely end of the Ukraine-Russia conflict in the near future, this deescalation could take six months to begin. This leads to another potential scenario of an going Food Crisis.

Before the Ukraine-Russia conflict started, there was a burning fire in within the resilience of the food supply chain. In 1970, there was a discussion of this challenge in which the food supply chain was fragile. The food supply chain was subject to a rapid change in demand in 2020. This change originated in China, which became an net importer of grains. There hasn't been a net import of cereal grains in China since 1990. There were also a series of climate related disruptions on the supply side that began to raise food prices. Even if the war ended in 6 months or less, this issue will still persist.

E-MINI S&P500 Futures

It will be a busy week at the Fed this week. The month end also requires wholesale market makers and funds to rebalance positions and book the wins as stocks settle in two days. The month end will be on Monday. Since Nov 24th, there have been 4-5 short positions built up. Net longs who purchased above 3912 have been able to sell into 4050 as a result of these short positions.When price enters these short positions (RED RECTANGLES/RED ARROWS), we will look at the reaction. Net longs should defend the 3990 area and then rotate back into 4015-4036.

My opinion is that until Fed Chairman Powell speaks on Wednesday, this move will consolidate lower and, after Powell's speech, net longs will be prompted to buy the upper stops. In the Green Area / Green Arrow, net longs are distributing their positions in front of 4057, which is a KEY for this rally to continue upward. If the price fails to surpass 4057 following Powell's speech, it will indicate a reversal to the downside. To begin distributing above 4057, net longs must break this Green Area with volume.