#12-02 | More Hawkisk Comments $SPX $SPY $ES_F, S&P500 LEVELS, $PDD $NFLX $MRNA $OKTA $FIVE $SNOW

3 major short positions that must be filled with inventory!

The market completely ignored most of Fed Chair Powell speech yesterday. Now just as the FED goes dark. Last minute comments from Fed's Bowman Says We Still Have A Lot Of Work To Do; Says But It Is Appropriate For Us To Slow The Pace Of Increases; Says I Expect Ongoing Increases In Rate Hikes At Coming Meetings. Reiterating the stance that the market should not get too far ahead and start ripping higher.

It was announced this afternoon by NY Fed President Williams that inflation is still far too high, and that it will take a couple of years for inflation to ease back down to target levels. There seems to be no end in sight to inflation's cause and effect, thus causing the market to experience more destruction of demand and price discovery for years to come as a result.

Approximately 15 minutes before market close, we received Fed's Barr's statement that inflation is far too high; that the Federal Reserve is quite focused on bringing inflation down to 2%; and that we have moved rapidly into restrictive territory this year. There is a need for the markets to realize that the Federal Reserve will destroy more demand in capital markets before we reach 2% in interest rates.

Money managers will rebalance and adjust for lower earnings following a repricing of earnings based on the Fed Funds Rate in Q1 2023. While today we did receive some numbers that the market liked, which were:

U.S. Personal Income For Oct. 0.7% Vs 0.4% Expected

USA PCE Price Index (YoY) for Oct 6.000% vs 6.000% Est; Prior 6.300%

Personal Spending MoM For Oct. 0.8% Vs 0.8% Expected

USA Core PCE Price Index (YoY) for Oct 5.000% vs 5.000% Est; Prior Revised from 5.100% to 5.200%

USA Core PCE Price Index (MoM) for Oct 0.200% vs 0.300% Est; Prior 0.500%

PCE Price Index MoM For Oct 0.3% Vs 0.5% Expected

Continuing Jobless Claims 1.608M Vs 1.573M Expected

Initial Jobless Claims 225K Vs 235K Expected

USA Challenger Job Cuts for Nov 76.835K vs 33.843K Prior

S&P500 Futures

In #12-01 we discussed these 2 outcomes below. In today’s RTH we were looking to fill the remaining of the first major gap between 4103.75-4051.25. Upon filling the gap the first upper targets was 4106.50 and then depending on reaction we could get to 4127.25. Today HOD sits at 4110.00 a nice 4.50 overshoot from out first target.

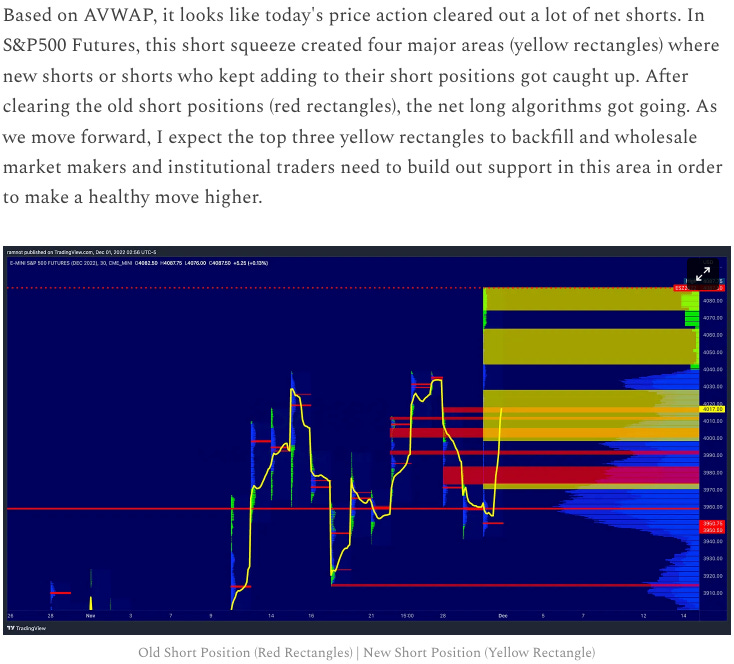

At the very end of our discussion we talked about S&P500 futures back filling into the 3 new major areas (yellow rectangles, in the chart below) where we deemed to be short traders caught off side.

Below is a chart that summarizes the move so far. As can be seen from the GREEN and RED rectangles in the chart below, wholesalers are accumulating inventory lower in order to move and sell higher. These are wholesale market makers that are balancing off incoming orderflow with their position. Until traders create a size move to remove either lower or upper stops, inventory will continue to be balanced and rebalanced. The inventory secured was distributed today once we reached our target of 4106.50, as indicated by the GREEN and RED ARROWS.

Using the chart below and the YELLOW rectangles. We are now looking for inventory to continue to build up in these 3 yellow zones. As the Fed made clear, do not attempt to front run its actions. The sentiment is to avoid getting ahead. We must prove that we can handle a nice rally towards the year's end during this blackout period if markets do indeed desire slower rates.

Levels:

Net longs need to defend 4054-4057 and we can rotate back above 4079.75, 4083.25

Net shorts need to break 4054.50 and continue to fill the lower short position / area of importance in the YELLOW rectangles.

LIS is 4079.75, bullish over & bearish under

Top Gainer: