S&P500 E-Mini Futures: ESZ

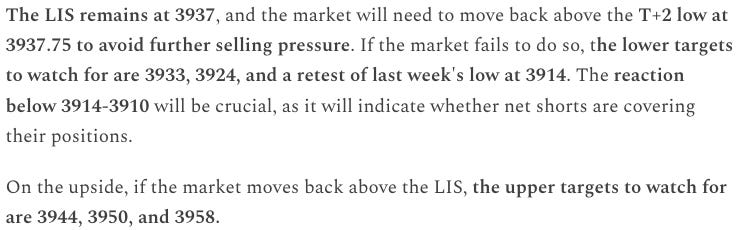

I believe that the market is currently being influenced by wholesale market makers who are hedging against incoming order flow. This has resulted in a consistent theme of shorts being caught off guard. As money managers price in the November CPI number, I think that this trend will continue. Yesterday, we saw the market move from 3937 to a high of 3992.75, indicating that there is potential for further upside.

Wholesale market makers are responsible for facilitating trade between buyers and sellers in the market. In order to do this effectively, they need to hedge against a wide range of potential outcomes, including longs, shorts, calls, puts, and various sub-strategies. This hedging can influence the market in unpredictable ways, and some experts believe that this is what is currently driving the trend of shorts being caught off guard.

The upcoming November CPI number is also expected to play a role in the market's movements. As money managers price this data into their strategies, market makers will need to adjust their hedging accordingly, which could lead to further market volatility.

As the market moves in the coming days, it is likely that wholesale market makers' actions and the CPI statistics for November are going to be key factors in the market's movements. Investors will need to pay close attention to these developments to make informed investment decisions in the coming days.

Today, we saw a significant shift in the market with our ESZ2022 contracts. Initially, we were able to hold steady at 3937 and move back into the T+2 Range, avoiding any further selling pressure. This allowed our net longs to have a clear path to the upside. I had set my upper targets for 3944, 3950, and 3958, and as we squeezed to the second short between 3992.25 and 3997.75, HOD was 3992.75.

Once wholesale market makers had finished building their positions in 3958, we cleaned it up and built out more volume there. The Point of Control for today was 3959.75. Once the position was secured, the first phase of the stop run was initiated to the upside. This was much higher than yesterday's targets, but within reach of the longs caught off guard during the PPI squeeze.

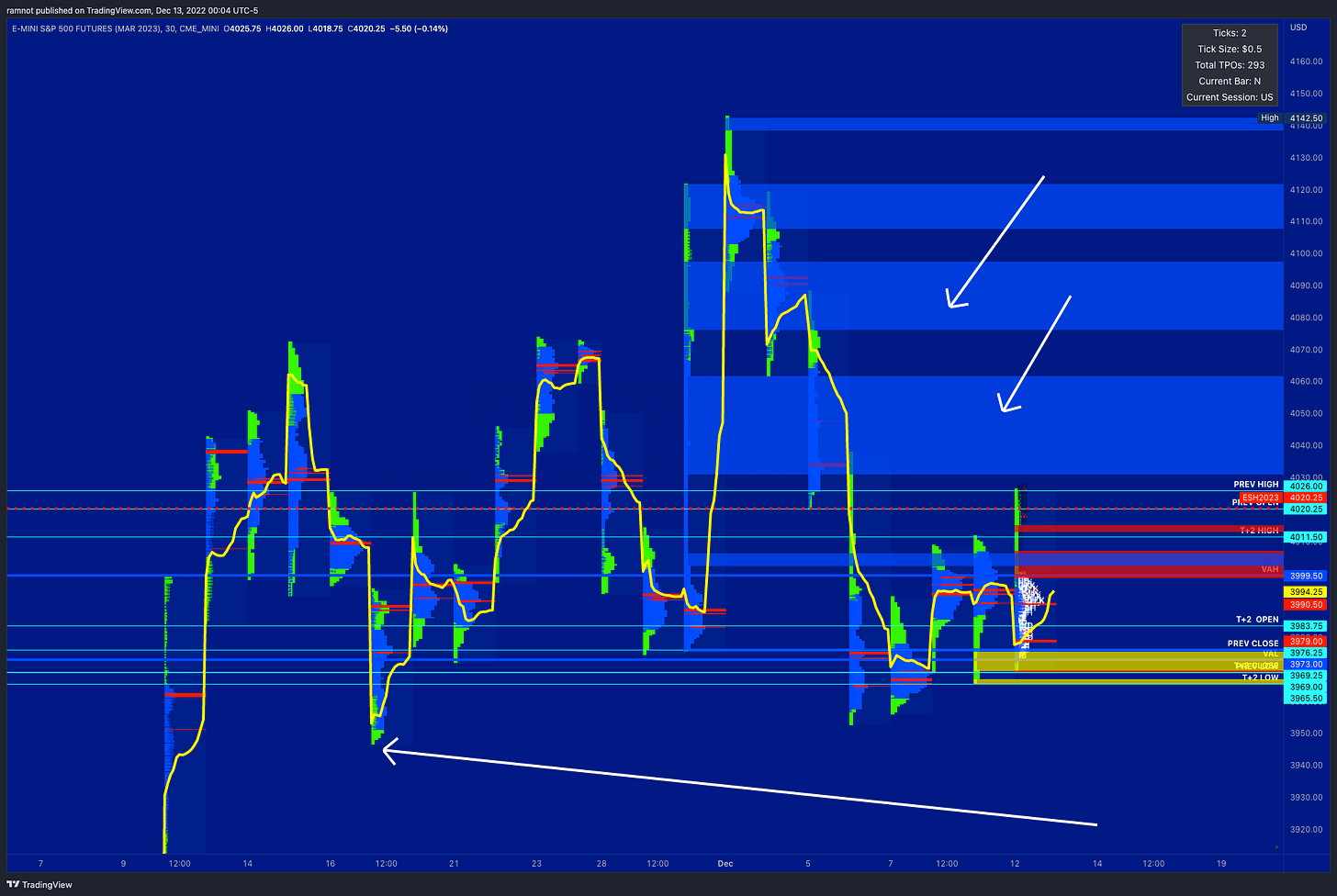

S&P500 E-Mini Futures: ESH

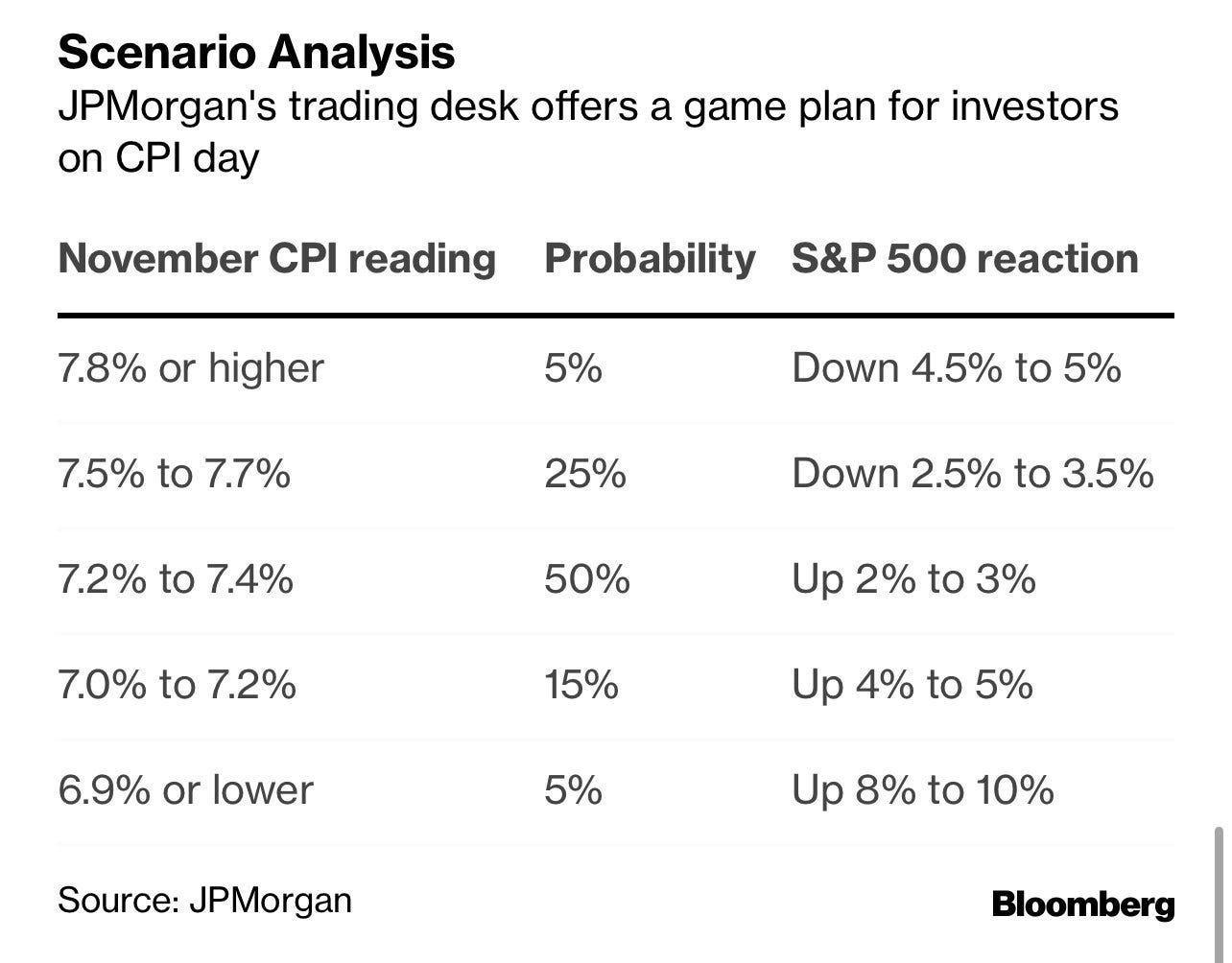

We are watching the reaction of the CPI number tmrw. JPMorgan;s trading desk offers a game plan.

ESH down 5% from Close = 3820

ESH up 5% from Close = 4219

LIS is 4011.50, the market will need to hold this area in order to move into the previous short position between 4031-4061.75. Based on the chart below, we will fill all short positions in BLUE. Upon breaking the T+2 Low upon the confirmation of a bearish CPI number, we will experience further selling and a possible break of 3946.50 should the T+2 High not be held and we sell off into the net long position at 3990.25. Should we break the T+2 Low upon the confirmation of a bearish CPI number, we will experience further selling along with a possible break of 4011.50.