#12-01 | FED PUT, $SPX $SPY $ES_F SHORT SQUEEZE, CHINA ZERO COVID, S&P500 LEVELS, TOP INSTITUTIONAL POSITIONS, SFB SAYS I AM DEEPLY SORRY

What a way to start DECEMBER! Wholesale Market Markers + Large Size Traders get to keep their book and FED BLACKOUT PERIOD BEINGS

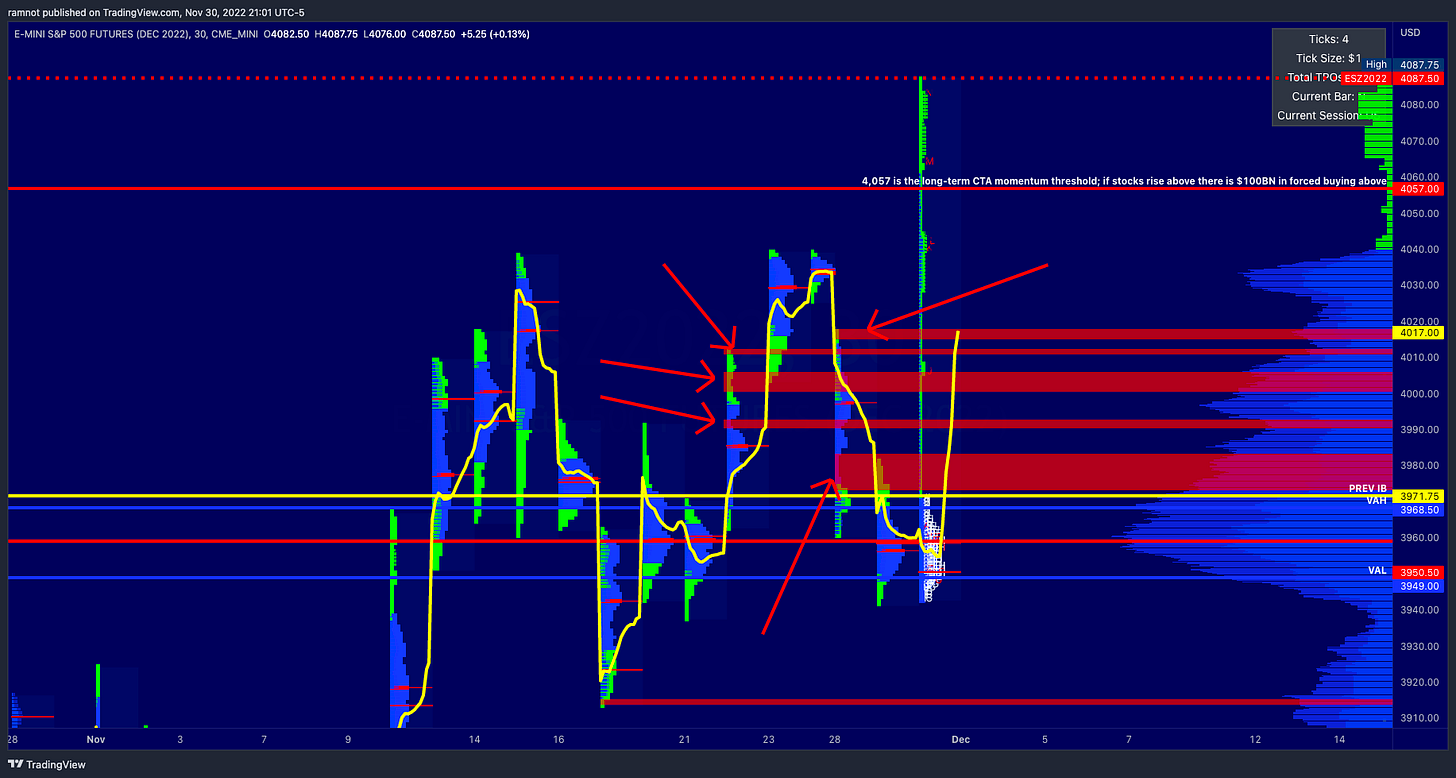

In an unexpected twist of events, headlines about Fed Chair Jerome Powell were published before he was scheduled to speak. As algos recognized the sentiment faster than large-sized traders, tons of traders chased the upside movement. It is possible that the Fed deliberately released headlines from his speech before his speech in order to give institutional algorithms an advantage. The Federal Reserve has entered a period of quiet period as of next week for 14 days upon the next policy change. As a result of the Fed's relief, net longs were able to force a short squeeze by running the upper stops (RED AREAS/RED ARROWS).

Let's take a moment to review what was said in the #11-28 plan on Monday: Two major events have occurred since Monday. In the first instance, funds and PMs are required to book their wins at month end to perverse clients wealth, make them some money and not expose their clients to too much risk. The second is the reaction to the speech by Fed Chair Powell. This orderflow is controlled by the net longs who are defending the 3912 position. We discussed on Monday that net longs to distribute above 4057 and that longs must break their previous highs with volume (green zone in the chart below).

Let's discuss key factors from the Federal Reverse that contributed to the upside movement of this market. During the period leading up to major Fed events. The presidents of each Federal Reserve will provide insight into their thinking. Yesterday, Federal Reserve Bank of St. Louis President Bullard stated that the tight labor market allows us to pursue a disinflationary policy. As a base case, 2023 is expected to be a year of slow economic growth. US GDP estimates for the fourth quarter are forecast to be positive, according to Bullard.

The US GDP numbers for the third quarter were released today; ACTUAL: 2.9% vs. 2.6% PREVIOUS; EST: 2.8%.

It was recently announced by the President William of the Federal Reserve Bank of New York that the Fed would have to maintain a restrictive Monterey policy for the foreseeable future. The Fed's decision on how to handle higher rates will be influenced by the economic environment. In addition, he suggests that in 2024, the Federal Reserve may lower interest rates. Despite the fact that the labor markets have been more resilient than expected, inflation risks are still to the upside, and the US economy is more vulnerable to shocks that may lead to recession.

The US JOLTS job openings for October were released today; ACTUAL: 10.334MM vs 10.717MM PREVIOUS; EST 10.250MM

US ADP Non-Farm Employment for November were realease today; ACTUAL: 127K VS 239K PREVIOUS; EST 200K

Let’s now breakdown the algo reaction to today’s comments from Fed Chair Powell. These 12+ comments were released seconds to minutes before Powell begin to speak at the Brookings Institution.

FED'S POWELL: WE HAVE A LONG WAY TO GO IN RESTORING PRICE STABILITY

FED'S POWELL: MAKES SENSE TO MODERATE PACE OF INTEREST RATE HIKES

FED'S POWELL: TIME TO MODERATE PACE OF RATE HIKES MAY COME AS SOON AS DECEMBER MEETING

FED'S POWELL: HAVE MADE SUBSTANTIAL PROGRESS TOWARD 'SUFFICIENTLY RESTRICTIVE' POLICY, HAVE MORE GROUND TO COVER

FED'S POWELL: 'IT SEEMS TO ME LIKELY' RATES MUST ULTIMATELY GO 'SOMEWHAT HIGHER' THAN POLICYMAKERS THOUGHT IN SEPTEMBER

FED'S POWELL: LIKELY TO NEED TO HOLD POLICY AT RESTRICTIVE LEVEL 'FOR SOME TIME'

FED'S POWELL: HISTORY CAUTIONS STRONGLY AGAINST PREMATURELY LOOSENING POLICY

FED'S POWELL: WE WILL STAY THE COURSE UNTIL THE JOB IS DONE

FED'S POWELL: INFLATION REMAINS FAR TOO HIGH

FED'S POWELL: OCTOBER INFLATION DATA WAS 'WELCOME SURPRISE,' WILL TAKE 'SUBSTANTIALLY MORE EVIDENCE' TO GIVE COMFORT INFLATION IS ACTUALLY DECLINING

FED'S POWELL: WE ESTIMATE PCE PRICE INDEX ROSE 6% IN 12 MONTHS THROUGH OCTOBER; CORE PCE ROSE 5%

FED'S POWELL: FAR TOO EARLY TO DECLARE GOODS INFLATION VANQUISHED, BUT IF TREND CONTINUES, GOODS PRICES SHOULD BEGIN TO EXERT DOWNWARD PRESSURE ON OVERALL INFLATION IN COMING MONTHS EXPECT HOUSING SERVICES INFLATION TO BEGIN FALLING SOMETIME NEXT YEAR, IF LEASE TRENDS CONTINUE

The initial move higher occurred after the algos picked up point 3. FED'S POWELL: TIME TO MODERATE PACE OF RATE HIKES MAY COME AS SOON AS DECEMBER MEETING. The algos initially detected this comment as an indication of an upcoming interest rate hike of .50 basis points rather than .75 basis points. We discussed in #11-28 that net longs must break 4057 with volume, so they did. On S&P500 Futures it was the highest bullish volume since October 13 when $ES_F was at 3502.

It was apparent today that all of Fed Chair Powell's negative / hawkish remarks were discounted based on the 75% chance of a .50 bps rate increase in December. The last time we experienced a 14 day Fed Blackout was in August, when S&P500 Futures went to 4327.50: now 4087.50.

In his statement, Fed Chair Powell reiterated his hawkish stance, saying we cannot achieve sustained periods of favorable labour market conditions without price stability. Inflation is declining but remains far too high, which requires substantial more evidence to provide comfort.

Inflation remains uncertain. Powell is considering the macroeconomic conditions that need to be in place to reduce inflation to 2% over time. By raising interest rates to an appropriate level, he will be able to achieve this goal. In spite of the fact that the Federal Funds rate has been increased to 375 basis points since March, it is unclear what rate will be sufficient.

Fed Quantitative Tightening has the purpose of slowing growth in aggregate demand. Slowing demand growth should allow supply to catch up with demand and restore equilibrium, which will lead to stable prices over time. As a result of tighter policy and slower growth over the past year, we have not seen clear progress in slowing inflation in recent months.

Current labor force shortages are approximately three and a half million people compared to pre-pandemic projections. In addition to a lower labor force participation rate, a decline in population growth has contributed to the shortage. Approximately 2 million of the shortage in the labor force can now be attributed to excess retirements, according to Fed economists.

Stocks and house prices rose in the first two years after the pandemic, leading some to retire early. The number of excess retirees continues to grow, and retirees don't appear to be returning in sufficient numbers. It is likely that about 1,1/2 million workers are missing due to a combination of a decrease in net immigration and a surge in deaths during the pandemic.

China’s ZERO-Covid

The IMF has been in discussion about gradually recalibrating China's ZERO-Covid policy. In light of the recent outbreak of COVID in China, activity may be hindered in the near future. According to Apple, the Covid-19 restrictions are temporarily affecting the assembly facility for the iPhone 14 Pro and iPhone 14 Pro Max located in Zhengzhou, China. This resulted in lower iPhone 14 shipments than had been anticipated.

The unrest at the world's largest iPhone factory could result in a 6 million unit shortfall by the end of the year, according to news reports on Monday morning. Following weeks of unrest at the plant over Covid restrictions and wage disputes, much depends on Foxconn's ability to hire new workers and resume full production on assembly lines. As a result, Apple has turned off AirDrop for Chinese users, which was an effort to circumvent the government. The Covid situation in China continues to deteriorate, lockdowns may cause further production disruptions in the weeks ahead.

S&P500 Futures

Net longs broke major upper resistance during Regular Trading Hours (RTH). Using the chart below we are very close to this established down trend (GREEN TRENDLINE). We also have AVWAP (yellow line) from ATH to present (4084.75), using AVWAP we can suggest that the average of the NET SHORTS are approx at 4085. The bulls need to break this green downtrend and move into 4150.75. Failure to takeout this DOWNTREND will result in the next move lower into 3817.

The TRENDLINE from March 2nd 2009 to April 2nd 2012, extended to present, has also been a key resistance level that was broken to the upside. We cannot be bearish as long as we remain above this GREEN dotted line. We will begin to sell off back to the 2022 lows once we reverse... later down the line and bulls are unable to defend this trendline.

In the event that NET SHORTS and BEARS become aggressive between 4015-4057 we can expect the next move lower. A possible path is drawn out below. We will go in details once we get the rejection higher. For now, the move is to the upside into 4130-4150 then 4146-4186.

Back to the shorter time frames, we had a violation of resistance around 4050 to the upside. We had discussed in #11-28 that 4057 would be a key level that bulls needed to break through with an increase in volume. Luckily, this scenario was accomplished. It is now necessary for net longs to defend the 4015-4050 area as a backfill to this area.

There is a possibility that longs will try to continue to chase this move higher. If this move higher continues, we will look for the 200 MA to act as support. If this area around 4060 holds up, then we can start to move towards the target of 4146, 4177.

In the event that BEARS become aggressive, the LIS before the inflection point of bears taking back control is 3924. As long as we are above 3924, we will rotate higher.

There’s 3 more gaps above the current price. The first major gap that price needs to clear is between 4103.75-4051.25 (yellow rectangle #3 from the top). Today, Powell's speech pushed the market into 80% of this gap. When this gap is filled and support is built, net longs will push $ES_F to our upper targets of 4106.50, 4127.25. Before any upper targets can be hit, the downtrend has to break and AVWAP has to hold (see chart 1 above)

Based on AVWAP, it looks like today's price action cleared out a lot of net shorts. In S&P500 Futures, this short squeeze created four major areas (yellow rectangles) where new shorts or shorts who kept adding to their short positions got caught up. After clearing the old short positions (red rectangles), the net long algorithms got going. As we move forward, I expect the top three yellow rectangles to backfill and wholesale market makers and institutional traders need to build out support in this area in order to make a healthy move higher.

Top Gainers

Today’s price action gave a little insight into where the large size traders and institutions are positioning for growth, market rallies, and bullish continuation. We’ll go into details later on areas of importance on these names. EL 0.00%↑ NFLX 0.00%↑ INTU 0.00%↑ META 0.00%↑ NVDA 0.00%↑ MU 0.00%↑ TSLA 0.00%↑ GOOG 0.00%↑ ABNB 0.00%↑ QCOM 0.00%↑ MSFT 0.00%↑ BABA 0.00%↑ AMD 0.00%↑ NOW 0.00%↑ DHR 0.00%↑ LRCX 0.00%↑ ADBE 0.00%↑ AMAT 0.00%↑ AVGO 0.00%↑

CNBC’s Andrew Ross Sorkin interviewed Former FTX CEO SFB