#12-09 | ECON DATA COMING IN COOL, PPI UP NEXT, RUSSIA CONFLICT, MERCHANT OF DEATH RELEASED, IMPACT TO $SPX $SPY $ES_F

Geopolitical instability is likely to continue into 2023. The ongoing conflict in Ukraine, tensions with Russia, and the potential for further sanctions and retaliation could all contribute

In recent months, the current administration has been criticized for engaging the United States in proxy wars without consulting Congress or the American public. A concern has also been raised regarding the inclusion of the European Union in the conflict, as European countries are now facing the consequences of Russia's actions.

Russia is clearly winning economically and strategically as a result of the conflict. By selling its oil inventories to countries such as China, Africa, and India, Russia has stabilized its economy and capitalized on the high demand for oil in these regions. As a result of US sanctions, Russia's surplus tripled to $95.8 billion in the first four months. In recent months, it has been argued that sanctions imposed by the U.S. and EU were ineffective since they restricted the free market and allowed Russia to prosper economically.

There have been concerns about the prudence of the foreign policy decisions of the current administration since it launched a proxy war without any discussion. These decisions are motivated more by an effort to virtue signal moral superiority and label countries and groups as "good" or "bad" than by an analysis of the potential risks and consequences. Foreign policy decision-making needs to be more transparent and accountable.

In early February, sanctions were imposed on Russia, which included a ban on trading the securities of Russian companies. The impact of the sanctions on pension and retirement funds in the United States and Europe has been criticized. As a result of the sanctions, American and European pensioners have effectively transferred wealth to Russia by taking $400 billion in market capitalization held by these funds and giving it to Russian companies free of charge.

Using diplomacy as an effective means of avoiding the war and preventing Russia's strengthening and the weakening of the Western alliance would have been more effective. The U.S. under the current administration has attempted to use the conflict as a proxy war instead of resolving it through negotiated settlement. This approach has not been successful, and its potential risks and implications are prolonging a conflict that need not have taken place in the first place. A good example of policy failures in this regard pertains to the failed prisoner swap negotiations involving Viktor Bout.

The recent prisoner swap between the United States and Russia, in which Viktor Bout, the arms dealer known as the "Merchant of Death," was released from American custody has raised concerns about the potential risks and implications of using prisoners and hostages in foreign policy decisions. Prisoners and hostages continue to play a complex and emotionally fraught role in foreign policy decisions as markets seek signs of geopolitical stability and data that can help stabilize prices.

The United States has a long-standing policy of not negotiating with terrorists, but the prisoner swap with Russia has raised questions about the consistency and effectiveness of this policy. Viktor Bout's history as an arms dealer and facilitator of weapons for terrorist groups, drug cartels, and other criminal organizations is well documented.

In a 2010 interview with 60 Minutes, former DEA agent Mike Ron described Bout as "one of the most dangerous men on the face of the Earth," highlighting his ability to facilitate the flow of weapons to conflict zones and his network of contacts at the highest levels of the Russian military. Bout's rise to power came following the collapse of the Soviet Union, when he took advantage of Russia's military contacts and established a fleet of 60 cargo planes capable of transporting weapons and military equipment to any location.

This prisoner swap between the United States and Russia, and the potential risks and implications in foreign policy. From the markets perspective the current administration is discounting the potential impacts on global stability, economy and markets by negotiating with terrorist or in this case letting one free during an escalation in geopolitical conflict.

Increased uncertainty and volatility: Negotiating with terrorists could create uncertainty and volatility in the stock market, as investors may be unsure of how to react to the situation and the potential risks and implications of such negotiations.

Reduced confidence in the government: Negotiating with terrorists could also reduce confidence in the government and its ability to effectively manage national security and foreign policy issues.

Reduced confidence in the economy: If the United States were to negotiate with terrorists, it could also reduce confidence in the overall health of the economy.

The Russia-Ukraine conflict, which has been ongoing for several months, shows no signs of abating, and there are concerns that the prisoner swap could further escalate tensions and contribute to destabilization in the region. Russia's strategy for the upcoming winter months is reportedly focused on weaponizing the cold weather by controlling natural gas and oil pipelines. With Viktor Bout back in Russia, there are concerns that the country could use its most favored arms dealer to further destabilize third world countries and support terrorist and insurgent groups.

In less than a month following reports that Ukraine has taken back 54% of the land captured by Russia since the beginning of the war, Russia holds approx. 20-22% of Ukraines land.

The return of Viktor Bout to Russia has raised concerns about the potential impact on the ongoing conflict in Ukraine. Bout has a unique skillset in evaluating bloody conflicts and transforming young warriors into insidious, mindless, maniacal killing machines that operate with assembly line efficiency.

Bout's expertise in arming and training soldiers for conflict could provide Russia with a strategic advantage, allowing it to escalate the conflict and potentially erase the gains made by Ukraine in retaking control of its territory. With his expertise, Bout is well-positioned to brief Russia's military on escalation tactics that is undermining the $68 billion in aid provided to Ukraine by the U.S.

Furthermore, the return of Bout to Russia could also have broader implications for global security;

The return of Viktor Bout to Russia has raised concerns about the potential impact on the conflict in Ukraine and global security. Bout has a history of arming terrorist and insurgent groups, as well as powerful drug trafficking cartel. Bout's unique skillset and expertise in arming and training soldiers for conflict could provide Russia with a strategic advantage, and his connections and experience could be used to further destabilize countries around the world.

S&P500 E-Mini Futures

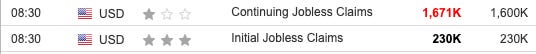

In today's labor market report, the Continuing Jobless Claims came in higher than expected while the Initial Jobless Claims were in line with expectations. These numbers align with the Federal Reserve's focus on cooling inflation and achieving price stability.

Tomorrow's Producer Price Index (PPI) release is a key event that could set the tone for the rest of the session. The PPI is expected to come in at 0.2% month-over-month.

If the PPI comes in higher than expected, it could weigh on the market if it remains below the 3953 area. However, if the PPI is weaker than expected and the market gaps up to open around the 4001 area, it will be important for the market to take out the 4001 level within the initial balance period, or it could fall back below 3953.

In yesterday's analysis, we discussed a potential directional move once the T+2 VAH at 3961 or the T+2 VAL at 3926 were breached. Today's price action showed support from net longs as the LIS at 3938.75 acted as support and halted supply from incoming net sellers, securing the net long position.

The chart below shows yesterday's targets with today's price action. As can be seen, the LIS was preserved and the upper stops were taken out. Today's high of the day was in the middle of a new short position, which will be the focus area. Overall, it was a strong day for net longs as the range was tight and key areas of price were held.

Tomorrow, my LIS is 3967.25. From this level, my targets are 3970.50, 3980.75, 3977, 3997.75. If we fail to hold the LIS, we will retest VAL at 3968.75, prev LIS at 3938.75.